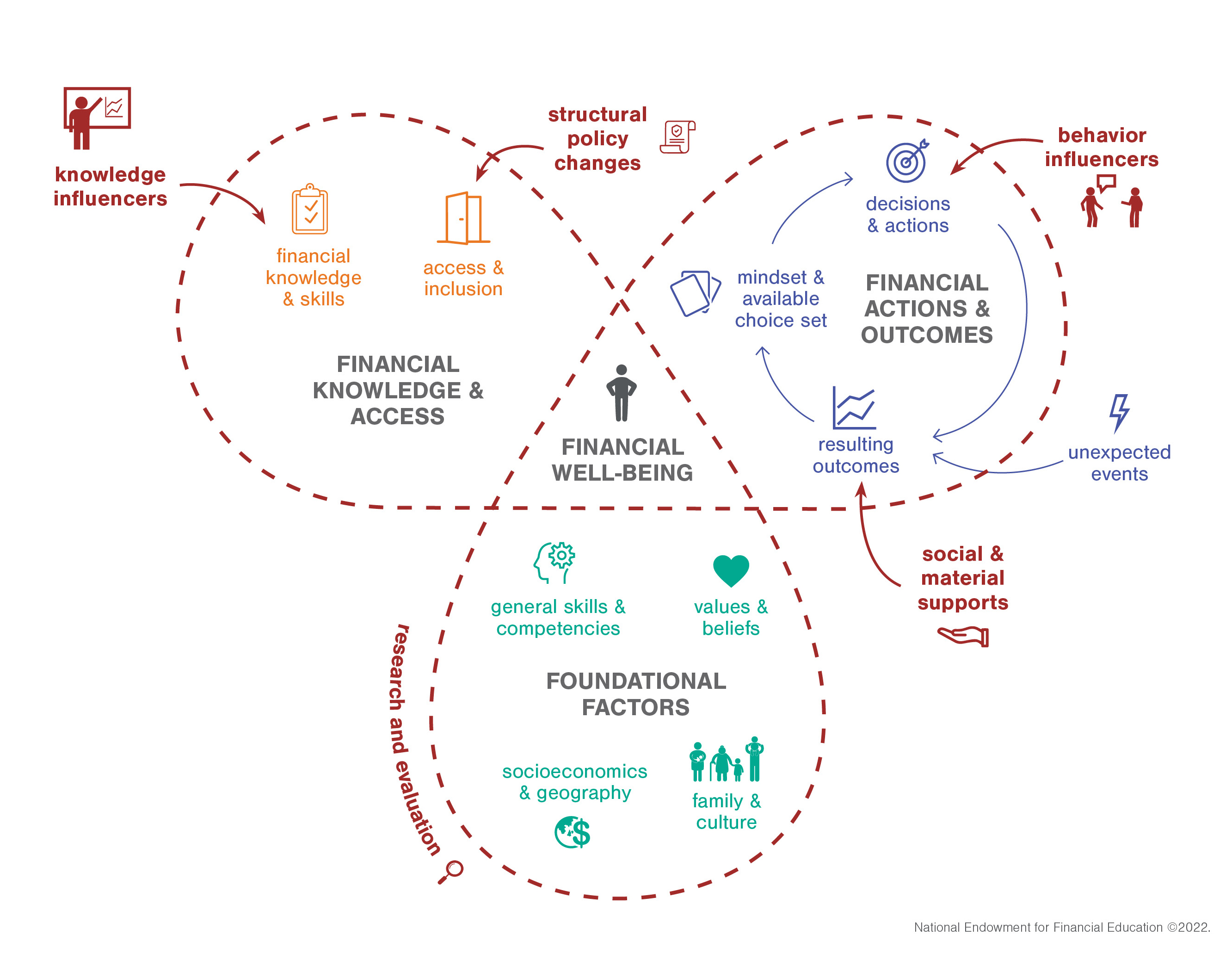

The National Endowment for Financial Education (NEFE) created the following Personal Finance Ecosystem visual roadmap. In a holistic way, the visual roadmap depicts different factors that impinge upon or impact an individual's level of financial well-being. See the companion NEFE video below.

Watch (An Intro to NEFE's Personal Finance Ecosystem)

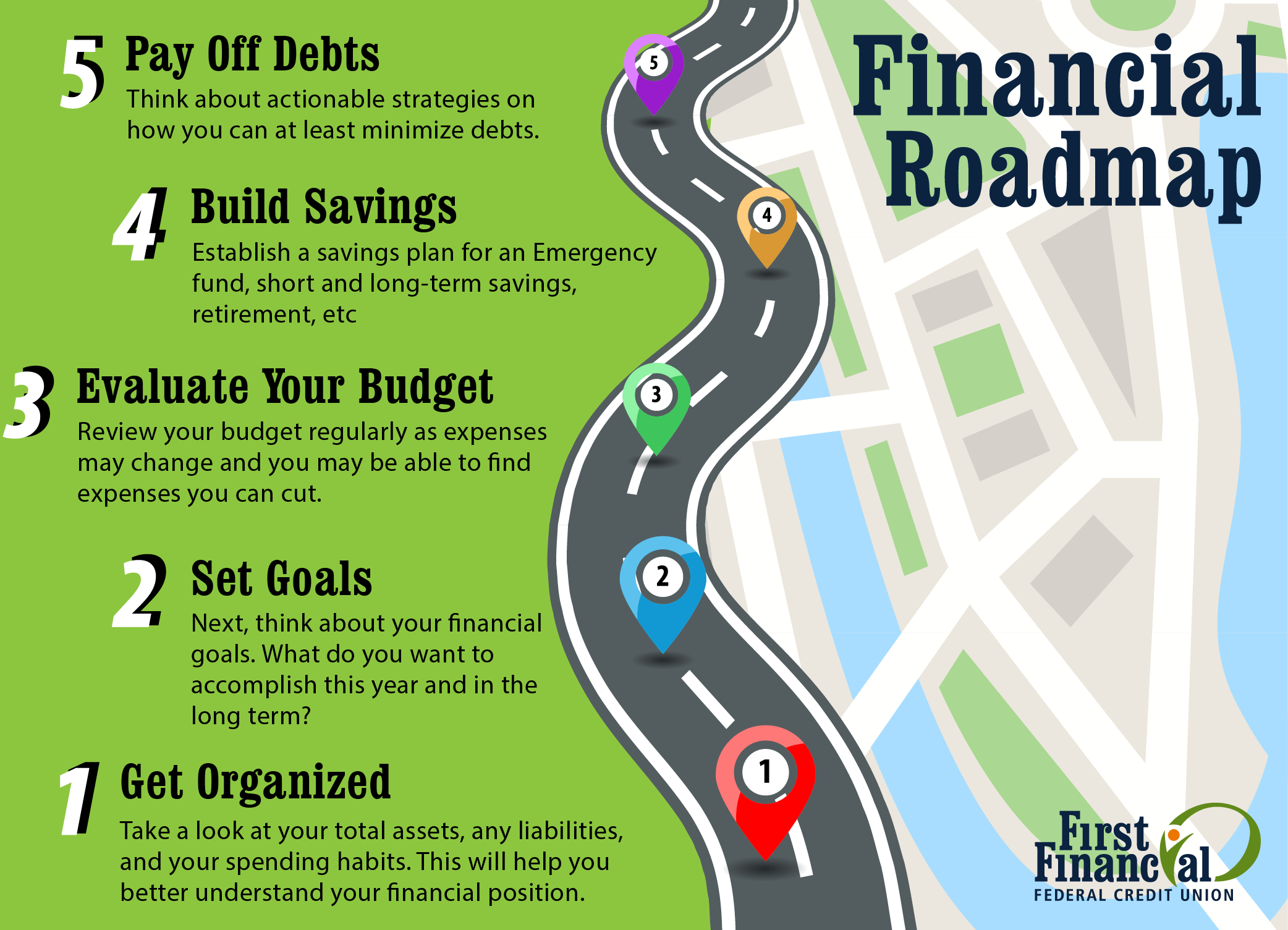

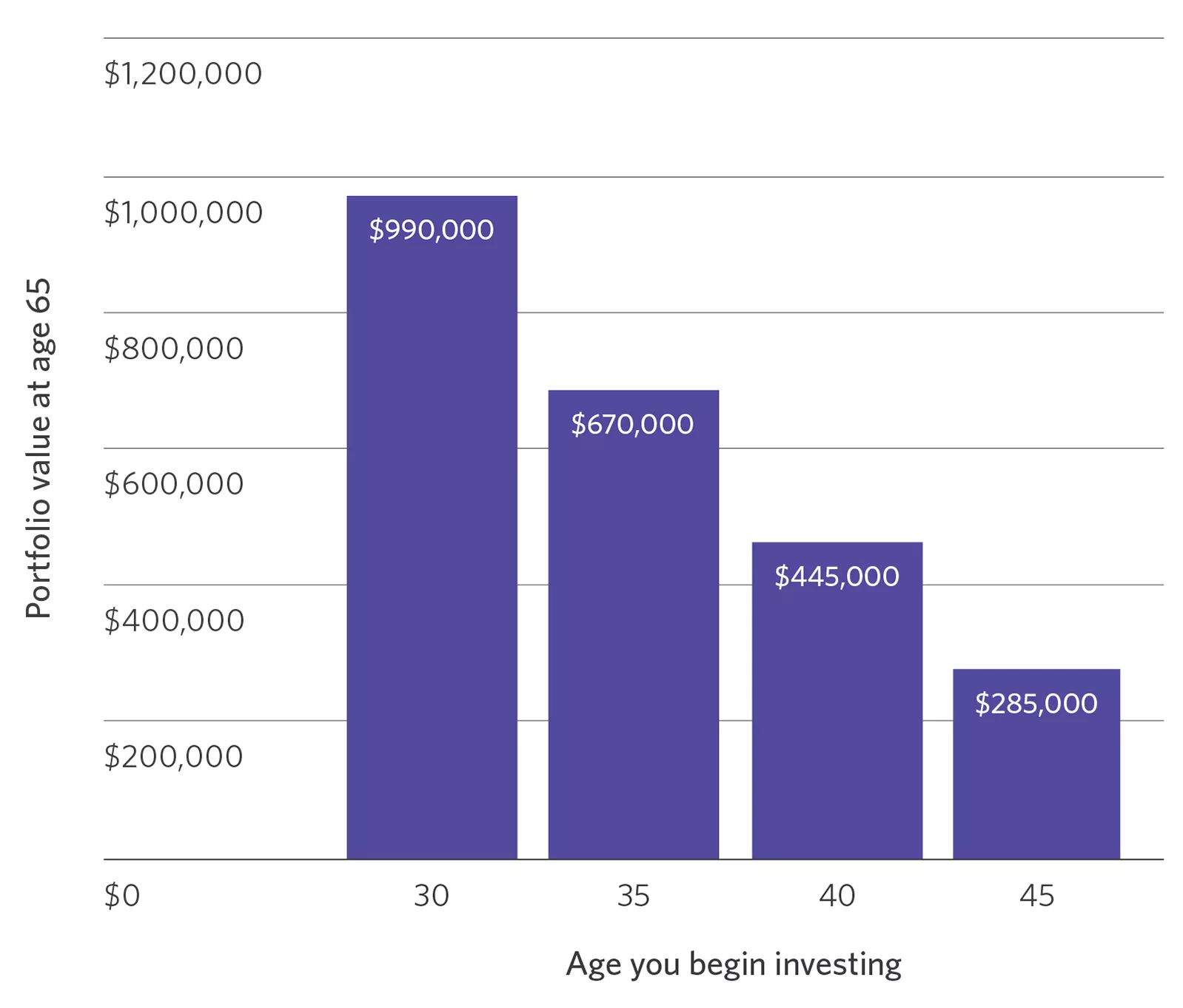

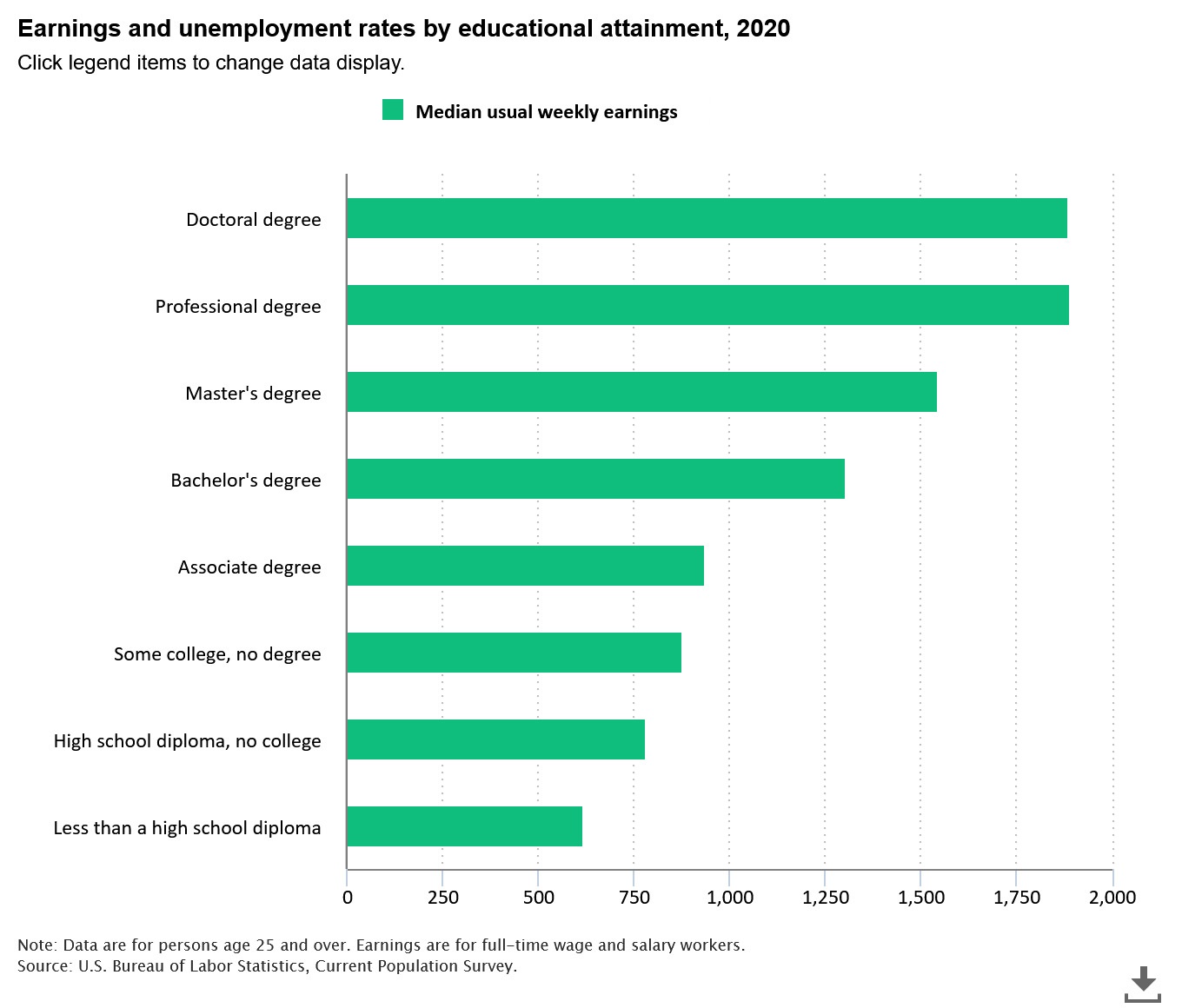

The objective of the ecosystem is for the individual or household to remain focused and not to be sidetracked while journeying down life's road towards personal financial stability, security, and prosperity. Ideally, it is preferable to start driving on your journey down the road at the earliest possible stage in life, namely, immediately after completing high school or graduating from college (as illustrated in the Edward Jones' bar chart below). The ideal travel trajectory would be to have a steady job or career; get married and start a family; become a homeowner and possibly a business owner; save, invest, and live comfortably during your working years; and retire comfortably when your working years are finished.

When it comes to the business of personal finance, the mymoney.gov website lists the following 5 pillars as essential for households to embrace in the quest to attain economic stability, security, and prosperity in life. Click the label on each of the 5 leaves on the graphic immediately below to read an interesting article on the topic of personal finance.

"1. EARN – Make the most of what you earn by understanding your pay and benefits.

2. SAVE & INVEST - It’s never too early to start saving for future goals such as a house or retirement, even by saving small amounts.

3. PROTECT – Taking precautions about your financial situation, accumulate emergency savings, and have the right insurance.

4. SPEND – Be sure you are getting a good value, especially with big purchases, by shopping around and comparing prices and products.

5. BORROW – Borrowing money can enable some essential purchases and builds credit, but interest costs can be expenses. And, if you borrow too much, you will have a large debt to be repaid."

Watch (These Are The Steps To Manage Your Money | Personal Finance Basics)

There are some who prefer to display up to 10 pillars of personal finance. The following graphic shows 9 pillars of personal finance. Insurance would serve as the 10th pillar of personal finance:

The following table presents some personal finance tools. These additional tools can be utilized to augment the above 5 pillars of personal finance.

The following two flipbooks provide more insights and guidance into the topic of personal finance.

Read (The Money Manual: The Essential Guide to Managing Your Money Well)

Read (Building Wealth: A Beginner's Guide to Securing Your Financial Future)

Generally but not exclusively speaking, these principles of personal finance are discussed here within the context of the free-enterprise economic system. Free-enterprise economic systems typically are characterized by private property ownership, openness, and individual liberties. Free-enterprise economic systems tend to excel at generating personal wealth. Free-enterprise economic systems also tend to excel at providing consumers with a wide array of consumption choices. In tandem with free-enterprise economic systems, societies whose social structures promote equality of opportunity and meritocracy seem to promote greater social and economic mobility for all citizens in that society. Each member of civil society should be afforded an equal opportunity to fully develop whatever talent he or she possesses. Each member of civil society should be afforded an equal opportunity to pursue and realize a career niche in life.

Education traditionally is viewed as the chief mechanism for achieving upward socioeconomic mobility in civil society. The main purpose of education is to prepare students to become responsible, productive, law-abiding, self-disciplined, and self-supporting members of society. Another purpose of education is to teach students how to behave civilly in society by leading principled and disciplined lives with a strong moral compass, which entails respect for self, respect for others, respect for the property of others, respect for the rule of law, and respect for human life regardless of race, color, creed, ethnicity, gender, sexual orientation, religion, disability, national origin, socioeconomic birth status, political opinion, and so forth. Character traits such as decorum, tolerance, and humility are also important in fostering harmony in civil society.

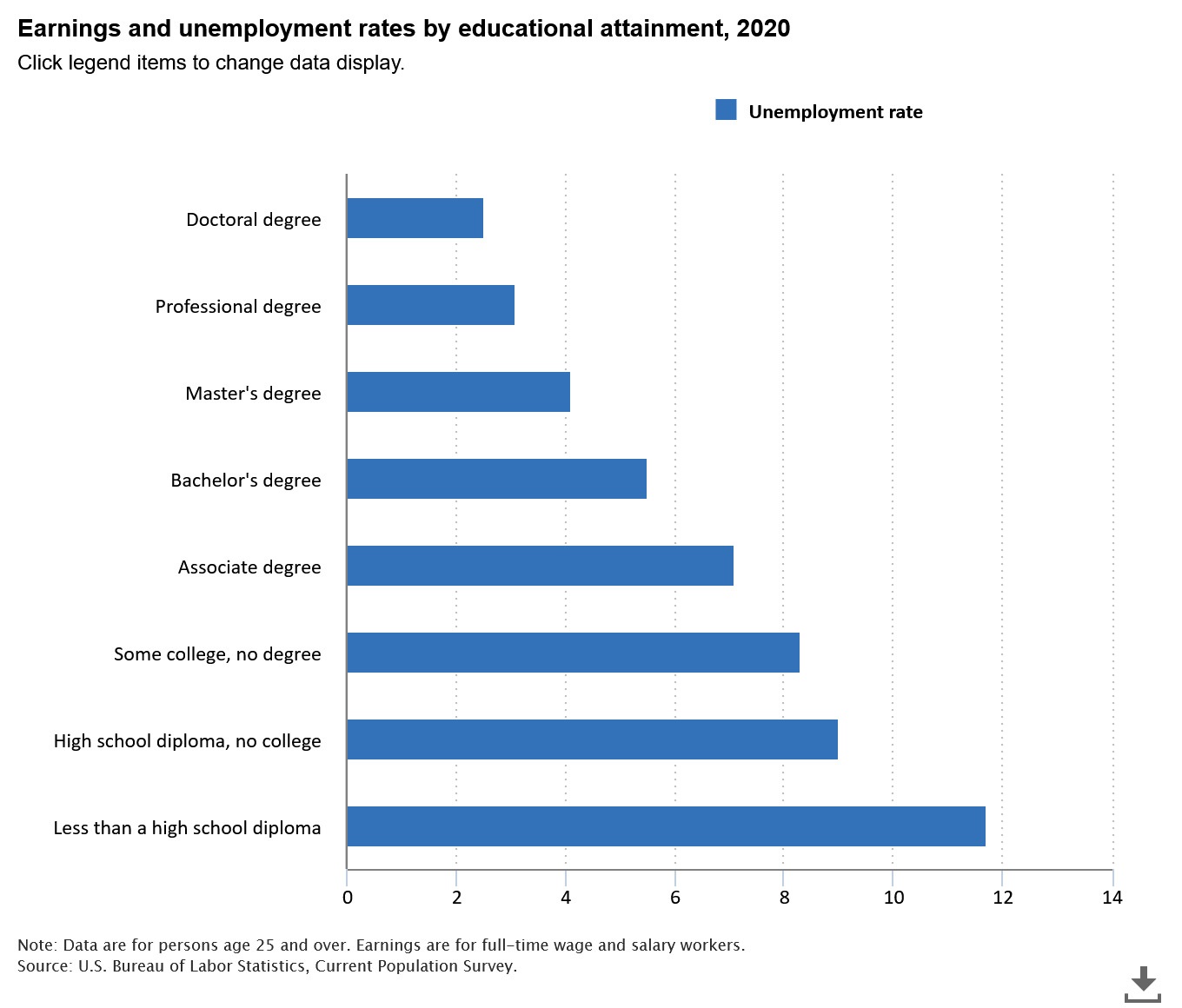

Stated simply, education pays. The next two graphics show how those with the most education tend to earn the highest amount of income during their lifetimes. Those with the most education also tend to experience the lowest amount of unemployment during their lifetimes.

Given this personal finance discussion, on a scale of 0 to 100, how would you rank the current state of your personal financial well-being? How would you rank your country's financial well-being?

Happy and safe travels as you embark upon your lifelong journey of traveling down the road to personal financial stability, security, and prosperity. To successfully navigate the personal-finance road, it does require a measure of structure and discipline in your personal affairs. Good luck.

For those who are interested in becoming wealthy, there are all kinds of ways to make lots of money in life. You do not have to possess a professional degree to make a lot of money in life albeit it certainly helps to be highly educated. Although not always easy, here are some of these alternative ways to make lots of money regardless of your educational level:

- Following prudent savings strategies

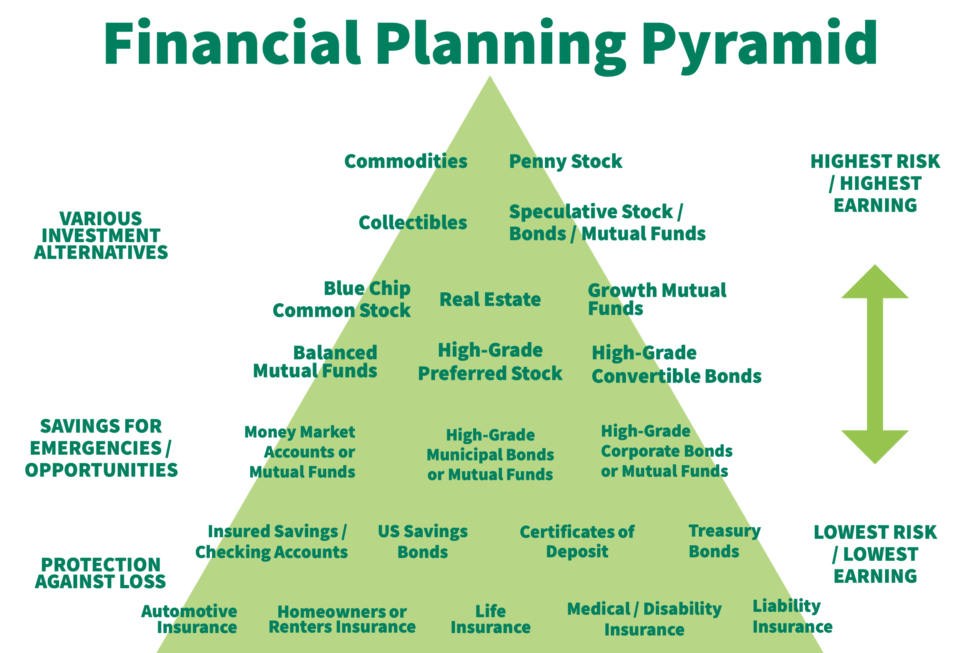

- Following prudent investment strategies

- Investing in real estate (especially purchasing a home)

- Successfully monetizing an online presence such as becoming a blogger, becoming an influencer, etc.

- Earning royalty payments from selling books, CDs, etc.

- Selling miscellaneous accessories online

- Starting a successful business

It is worth noting that all of this talk about making lots of money is easier said than done.

Watch (How to Make a Million Dollars)

For additional details about personal finance, also take a look at these two links: (1) Homework and (2) How Money Works.

Caveats and Qualifications: It should be noted that, in your quest to become a millionaire, in his book titled The Economics of Poverty, Alan Batchelder noted that a key prerequisite to attaining prosperity and finding your niche in society presupposes the presence of—and access to—physical capital to work with such as stores, factories, machinery, tools, heavy equipment, computers, infrastructure (such as transportation networks; communications networks; water and waste treatment systems, power grids; farm and irrigation networks; bridges; school systems; banking systems and financial networks), and so forth.

As an aside, not only are stability, security, and prosperity essential traits for individual members of society to live the good life but also the presence of these traits is essential for nations to thrive. Perpetual national divisiveness, fighting, warring, and killing are not helpful to the cause of achieving national prosperity because the opposite of order is chaos. The opposite of the rule of law is anarchy. The opposite of civility is barbarity.

Appropriately, political disputes in society (if not adjudicated in a court of law) should be settled in a civilized manner through spirited debate, an exchange of ideas, engaging in negotiations, reaching a compromise, voting to adopt a course of action with the majority vote prevailing without any recourse to threats, violence, cheating, and sabotage. Business leaders do not like to locate in—nor do tourists wish to visit—places on Earth where there is constant political upheaval, work stoppages, and general uncertainty. Business leaders do not like to locate in—nor do tourists wish to visit—places on Earth where there are rebels and thugs running around shooting up the country, raping women, taking hostages, engaging in acts of torture, and murdering their perceived opponents. Business leaders do not like to locate in—nor do tourists wish to visit—places on Earth where there are disaffected citizens detonating bombs in cars and detonating bombs in other public spaces. Business leaders do not wish to locate in—nor do tourists wish to visit—places on Earth where there is constant rioting, social upheaval, rampant crime, kidnappings, and destruction of property.

Business leaders do like to locate in—and tourists do like to visit—places on Earth where their business facilities will be safe because these facilities usually reflect a huge monetary investment. Business leaders do like to locate in—and tourists do like to visit—places on Earth where they are assured of societal stability and personal safety. Business leaders do like to locate in places where they are assured of the continuity of their business operations.

Attaining national prosperity requires the presence of social cohesiveness and the rule of law in society. The prevalence of religious fanaticism and a preoccupation with the practice of witchcraft, voodoo, sorcery, animism, magic, tribalism, and nepotism in society is detrimental to the task of attaining prosperity for an entire country.

Scroll up