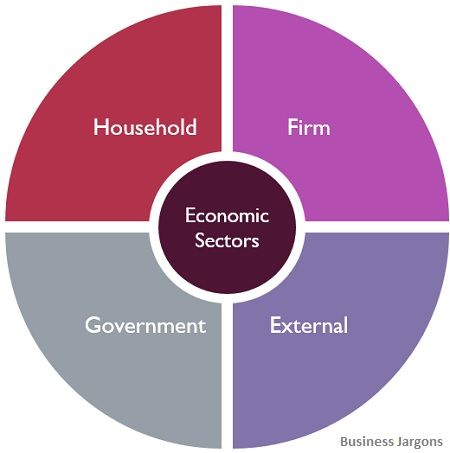

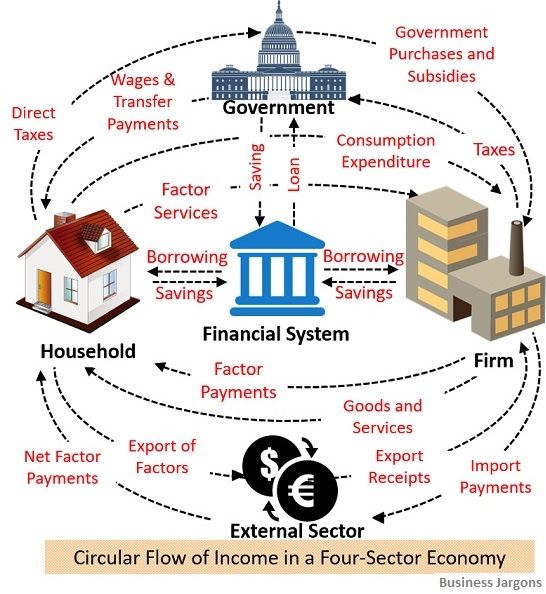

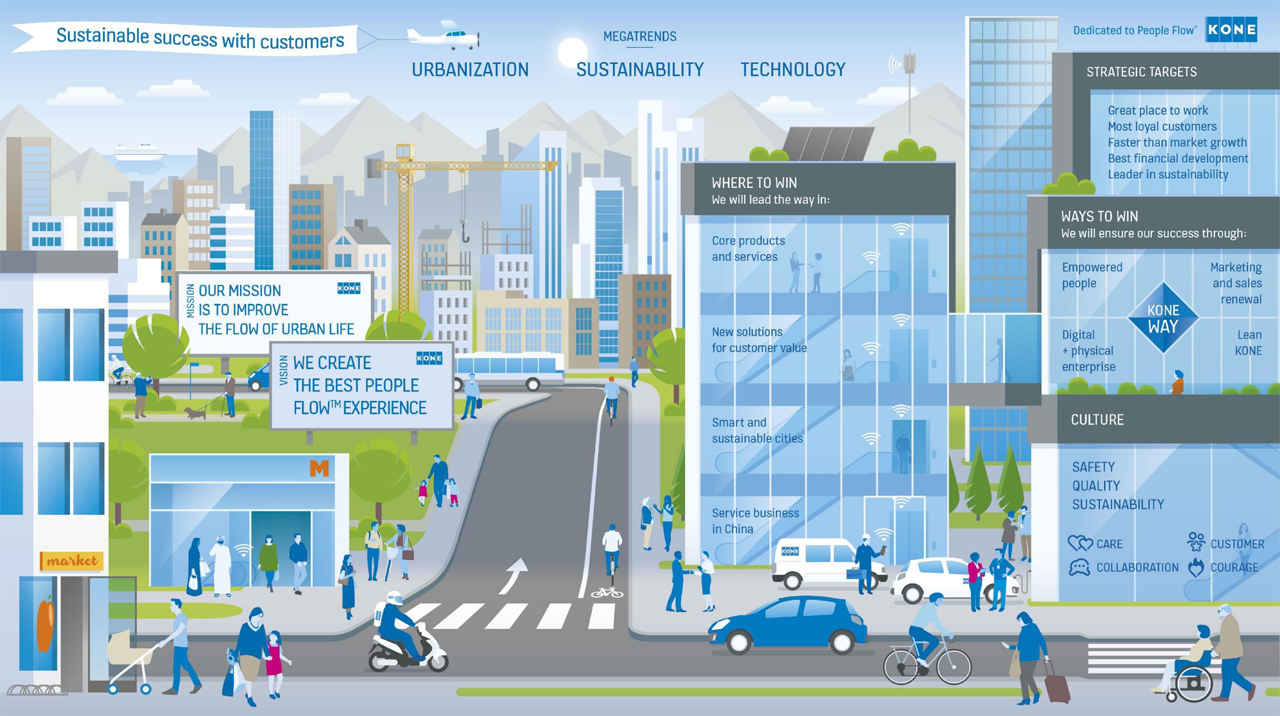

As mentioned on the Government Sector page of this website, and as illustrated by the next three images, from a high-level perspective, the circular-flow model often is used to encapsulate how a free-market economy works. In the first three images below, the Financial Sector (particularly, the banking sector) is depicted as playing a central or pivotal role in a free-market economy.

A Quick Review of the Financial Sector

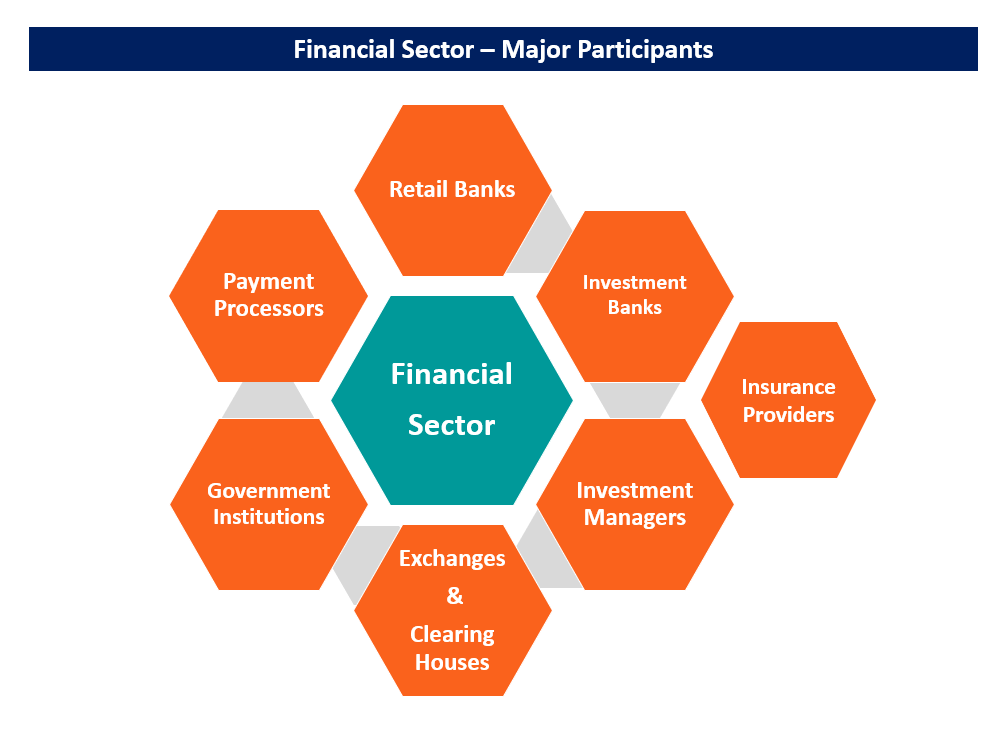

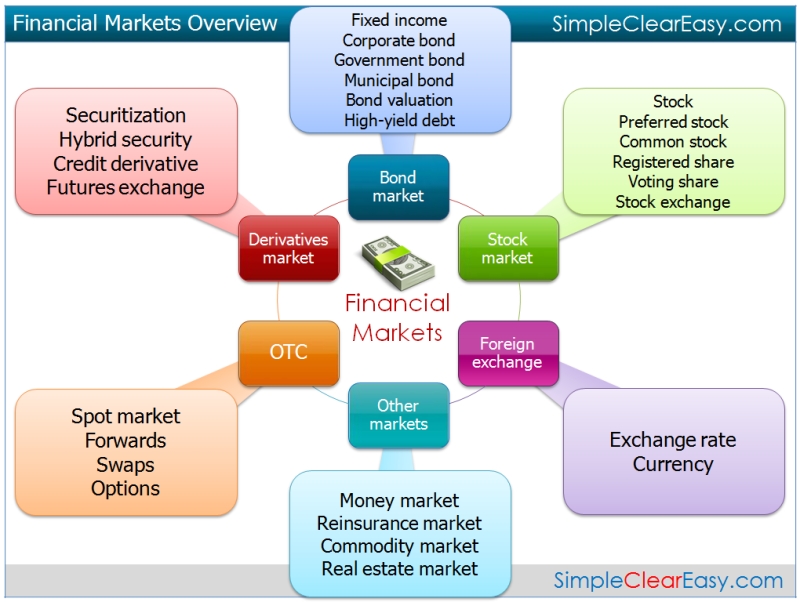

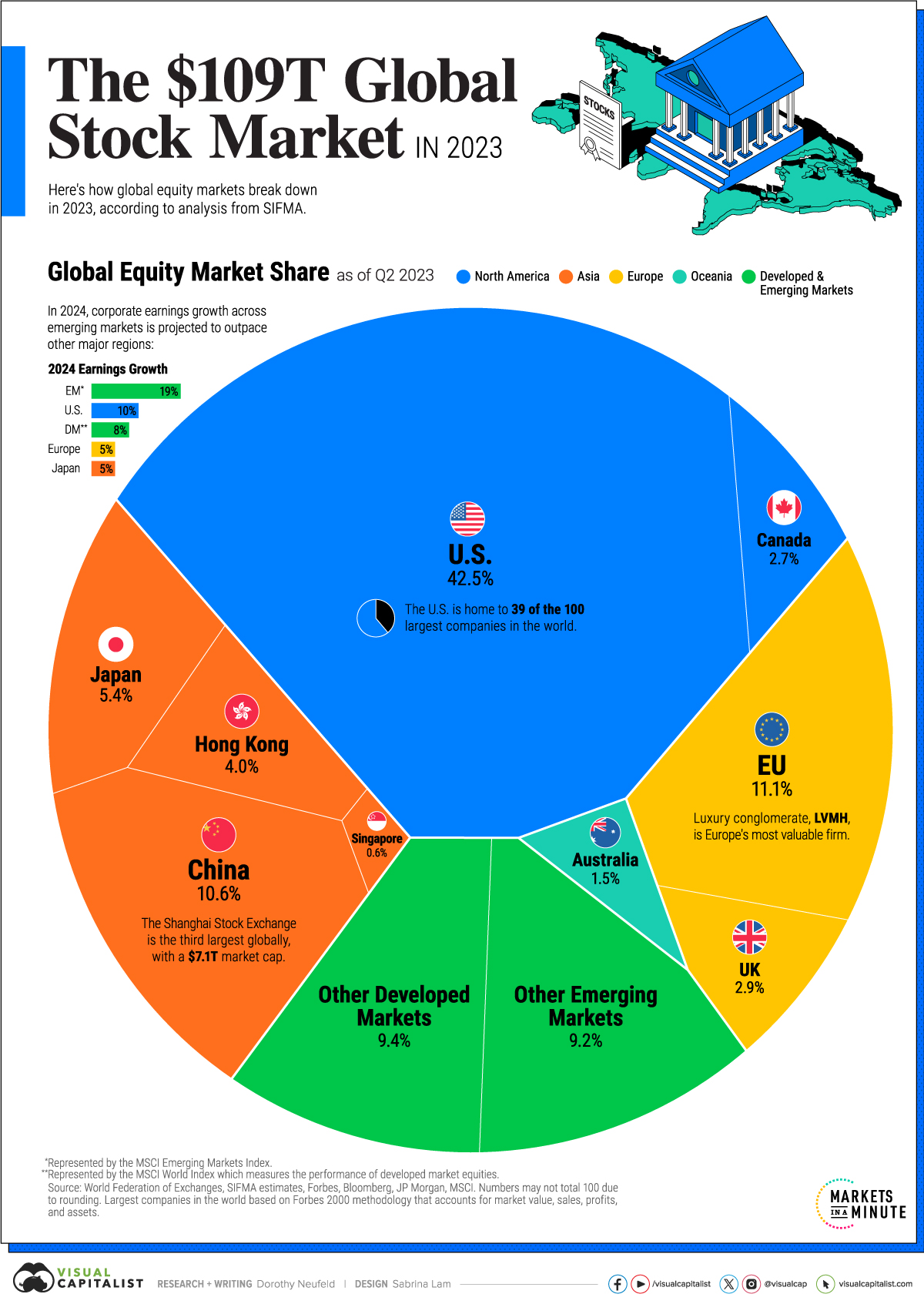

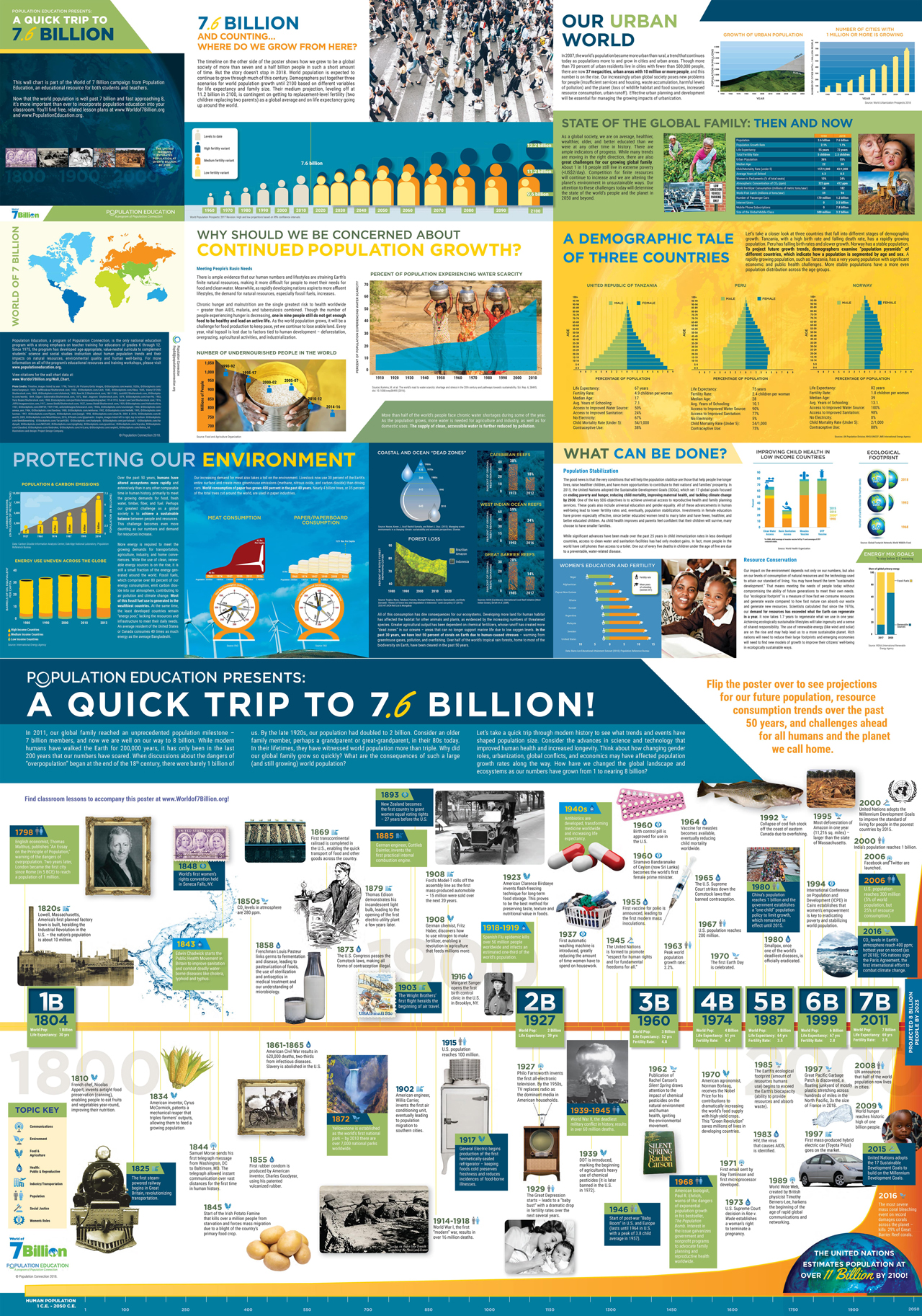

In its examination of financial markets, the website WalltSreetMojo aptly describes the Financial Sector as "the market where the sale and purchase of financial products occurs. Such products include stocks, bonds, currencies, derivatives, commodities, cryptocurrencies, etc. It acts as a platform for sellers and buyers to connect and deal in their desired financial assets at a price determined by market forces." Inherent in WalltSreetMojo's description, the Financial Sector is comprised of several interlocking components or participants as depicted by the next two graphics.

The next video provides additional insights into how financial markets operate and its intersection with the private sector.

Watch [How Wall Street Works: The NBR Guide to Investing in the Financial Markets (1990)]

Successfully running a Financial Sector operation reduces to adhering to astute management principles, that is, adhering to techniques to most efficiently run the operation while realizing the highest quality and quantity of output in a bid to attract customers and maximize profits. The Private Sector and the Financial Sector also utilize the tools of finance and accounting in their endeavors to maximize profits.

The tools page of this website presented several useful tools that can be used to monitor the latest trends in financial markets. The WalltSreetMojo website provides additional tools to gauge the performance of the Financial Sector.

The Role of the Banking System and the Government's Central Bank

There can be no discussion of financial markets without a discussion of the vital role that financial institutions, namely, banks, play in the overall scheme of things within the Financial Sector. Banks offer an array of products to their clients. These products include:

- Personal Banking

- checking accounts

- savings accounts

- credit card accounts

- auto loans

- home loans

- personal investment accounts

- Small Business Banking

- payment solutions

- payroll services

- cash-flow monitoring

- lines of credit

- secure and unsecured loans

- tax payments

- retirement account management

- health and benefits plan management

- Wealth Management

- wealth planning

- retirement planning

- tax planning

- trust services

- investment products

- investment accounts

- market trading

- Large Business Banking and Global Banking & Investments

- an array of commercial, business, and investment banking services tailored for large corporations and global clients

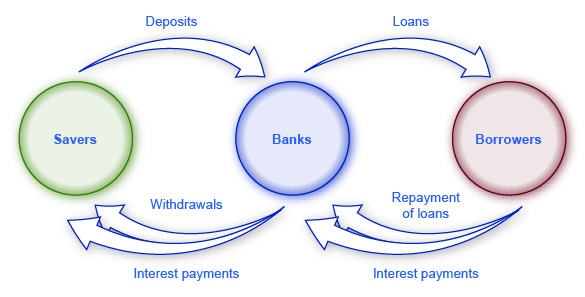

In the case of savers and borrowers, a bank is a place where they meet—often virtually—to exchange money (for a fee). In the case of buyers and sellers, a financial exchange is a place where they meet—often electronically—to trade different types of financial instruments (for a commission). Obviously, when viewing the above menu of products generally offered by banks, loans based on checking and savings account deposits are but a small percentage of their portfolios of assets.

Watch (Macro 4.4A - Banking - Bank Balance Sheets Made Easy)

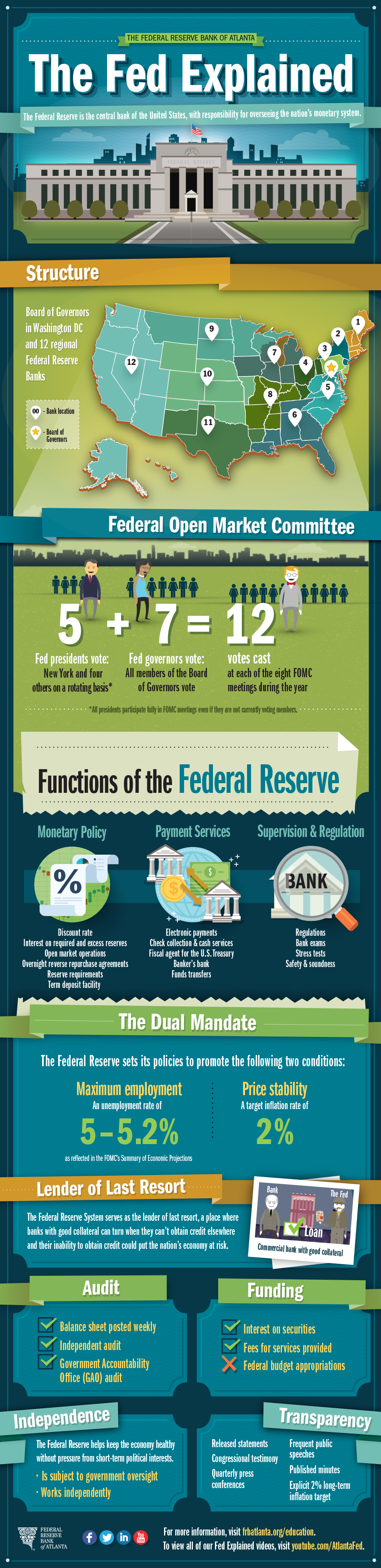

Time and again, experience has shown that, if the free-market system is left alone to run its course without any governmental oversight, intervention, or regulation, then it is inevitable that a substantial market failure will occur. Recall the stock market crash of 1929 and the subsequent Great Depression from 1929 to 1939. National Government Banks were formed to safeguard against economic havoc caused by free-market failure, in general, and bank failures, in particular (such as the USA's Federal Reserve System or Fed was formed).

The Federal Reserve System is the central bank of the United States. It performs five general functions to promote the effective operation of the U.S. economy:

- conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy;

- promotes the stability of the financial system and seeks to minimize and contain systemic risks through active monitoring and engagement in the U.S. and abroad;

- promotes the safety and soundness of individual financial institutions and monitors their impact on the financial system as a whole;

- fosters payment and settlement system safety and efficiency through services to the banking industry and the U.S. government that facilitate U.S.-dollar transactions and payments; and

- promotes consumer protection and community development through consumer-focused supervision and examination, research and analysis of emerging consumer issues and trends, community economic development activities, and the administration of consumer laws and regulations.

Source for bullets above:

The Fed Explained

Watch (The Federal Reserve System | The Fed Explained)

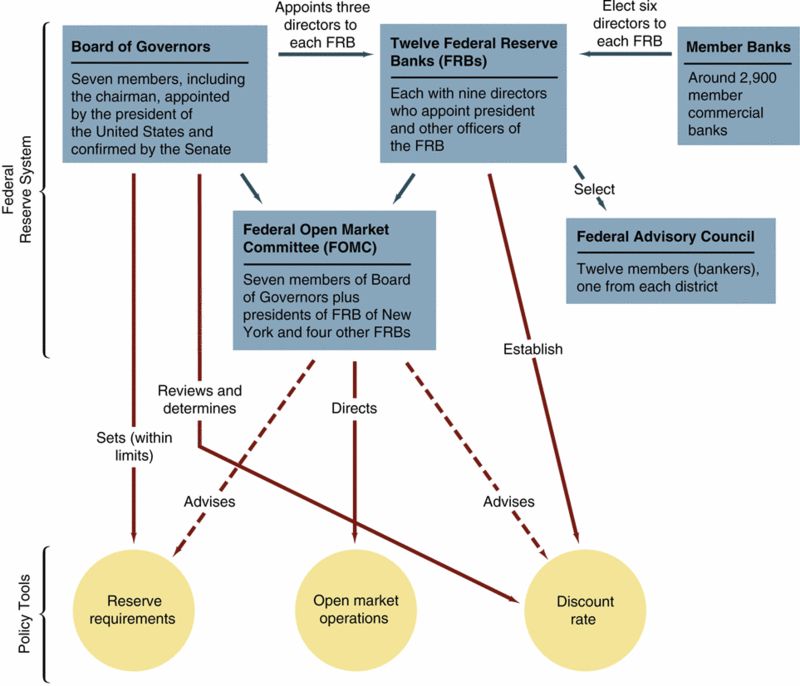

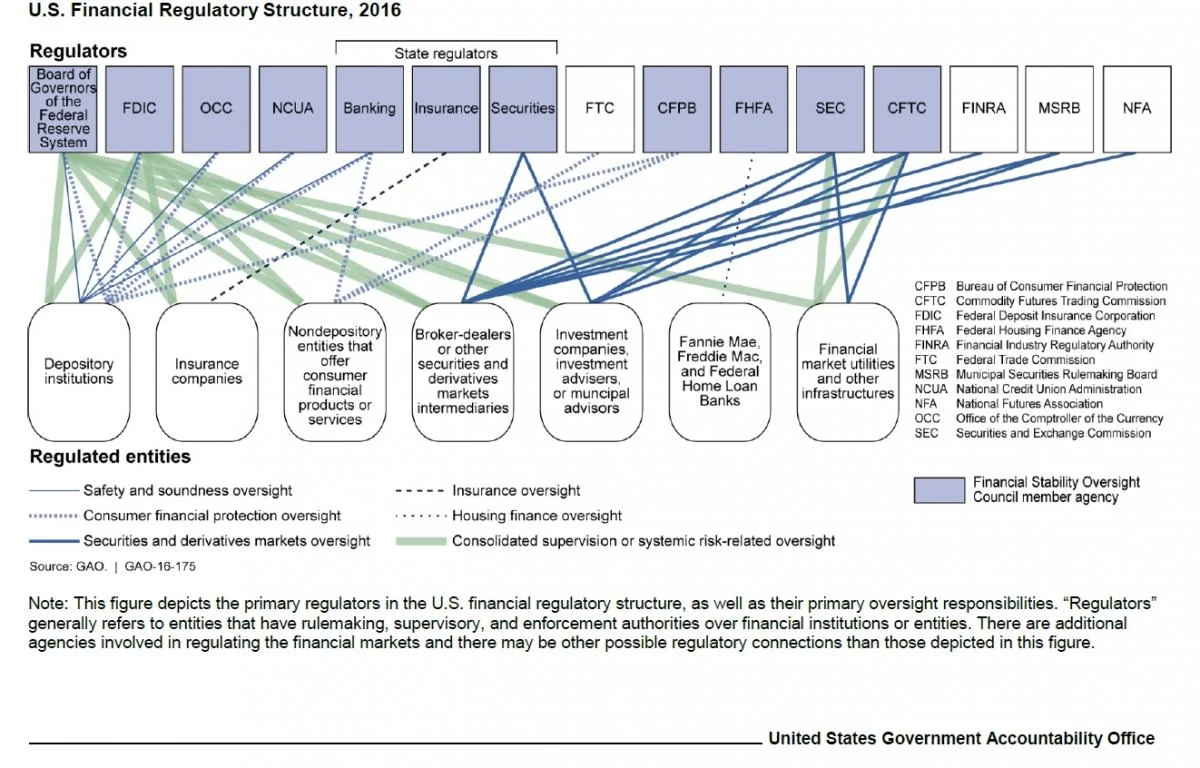

If left alone, the free-market ultimately might devour itself in the competition for profits. Oversight and intervention from the government come in the form of laws and rules to regulate the actions and activities of free-market players. It is worth noting that, over the years since its 1913 creation by Congress, the Fed has not always succeeded in executing its mission (such as implementinh policies to avoid or ameliorate the adverse impacts of the Great Depression). Given the reality of economic cycles, the Fed has grown wiser with the passage of time. Overall, by far, the Fed has performed commendably. The next image provides a fuller view of government oversight over financial markets of which the Fed is but one such player.

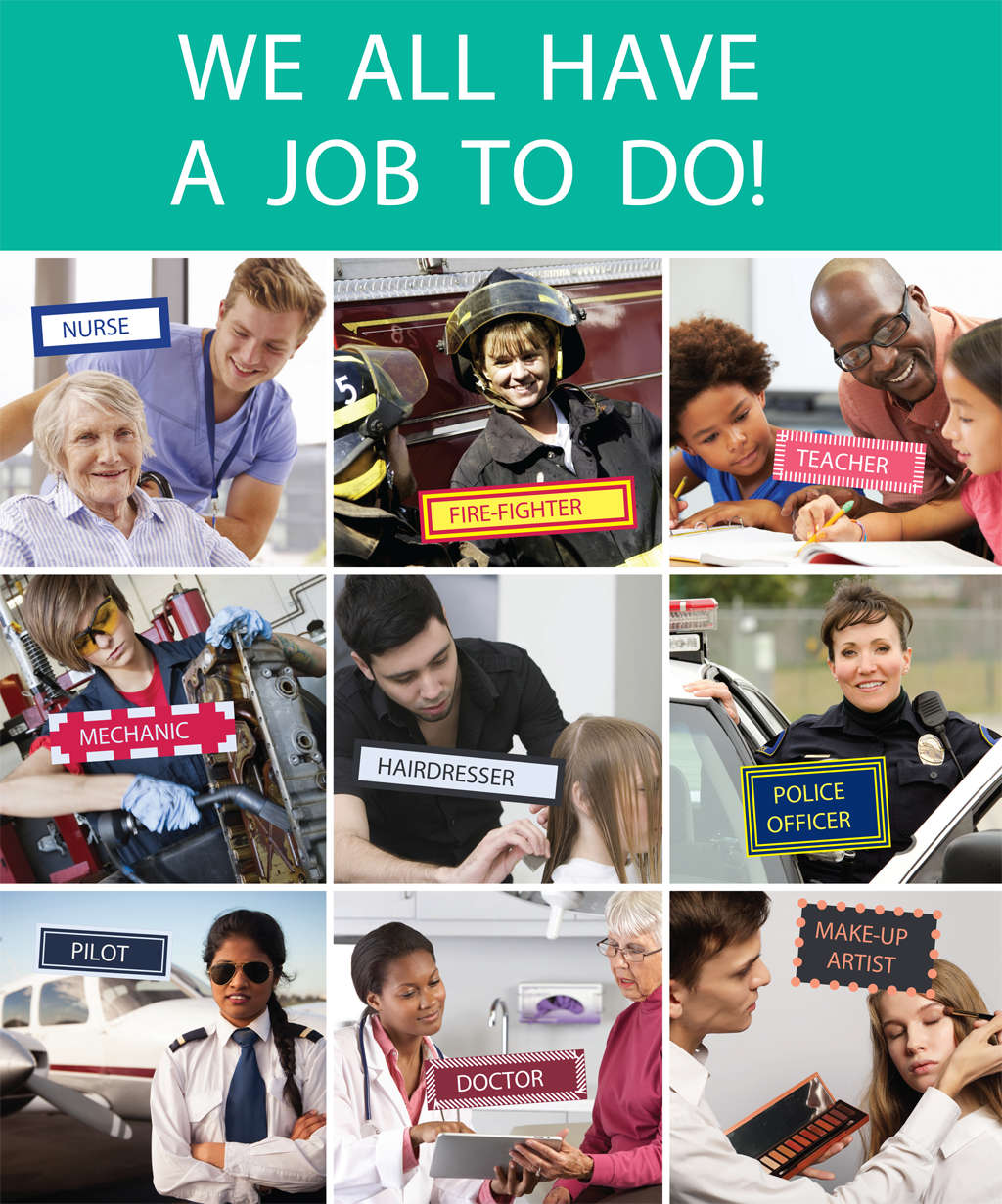

People Make The World Go Round

Some in society contend that money is the root of all evil. Others in society contend that money is the anthem of success. Some people opt to acquire money by lawful means. Others, regrettably, opt to acquire money by unscrupulous and unlawful means—even, in some instances, to the extreme act of committing the cardinal sin of murder. Everybody realizes that, love it or hate it, money is the one thing that makes the world go round. But, of course, according to the Stylistics, the truth of the matter is that people make the world go round (in the daily quest to find a niche and make a living). (See music video below.)

Watch (The Stylistics, People Make The World Go Round)

Scroll up